-

Table of Contents

- UM/UIM: What That Auto Insurance Coverage Means and How It Helps in an Accident

- Understanding UM/UIM Coverage

- The Importance of UM/UIM Coverage

- 1. Protection Against Uninsured Drivers

- 2. Protection Against Underinsured Drivers

- 3. Peace of Mind

- How UM/UIM Coverage Helps in an Accident

- 1. Medical Expenses

- 2. Vehicle Repairs

- 3. Lost Wages

- 4. Pain and Suffering

- Case Studies and Statistics

- Case Study 1:

- Case Study 2:

- Statistics:

- Conclusion

UM/UIM: What That Auto Insurance Coverage Means and How It Helps in an Accident

When it comes to auto insurance, there are numerous coverage options available to protect you and your vehicle in the event of an accident. One such coverage that is often overlooked or misunderstood is UM/UIM coverage. UM/UIM stands for Uninsured/Underinsured Motorist coverage, and it can be a crucial component of your auto insurance policy. In this article, we will explore what UM/UIM coverage entails, why it is important, and how it can help you in an accident.

Understanding UM/UIM Coverage

UM/UIM coverage is designed to provide financial protection to policyholders who are involved in an accident with a driver who either does not have insurance or does not have enough insurance to cover the damages. In many states, UM/UIM coverage is mandatory, while in others, it is optional. However, even in states where it is not required, it is highly recommended to include this coverage in your policy.

UM coverage applies when you are involved in an accident with an uninsured driver, meaning a driver who does not have any auto insurance coverage. On the other hand, UIM coverage comes into play when you are involved in an accident with an underinsured driver, meaning a driver who has insurance but not enough to cover the full extent of the damages.

The Importance of UM/UIM Coverage

Now that we understand what UM/UIM coverage is, let’s delve into why it is important to have this coverage in your auto insurance policy.

1. Protection Against Uninsured Drivers

According to the Insurance Research Council, approximately one in eight drivers in the United States is uninsured. If you are involved in an accident with an uninsured driver and you do not have UM coverage, you may be left to bear the financial burden of the damages yourself. This can be a significant financial setback, especially if you have medical expenses or your vehicle requires extensive repairs.

Having UM coverage ensures that you are protected in such situations. If the at-fault driver does not have insurance, your UM coverage will step in and cover the damages, up to the limits of your policy. This can provide you with peace of mind knowing that you are not solely responsible for the costs associated with the accident.

2. Protection Against Underinsured Drivers

Even if the at-fault driver has insurance, their policy may not have sufficient coverage to fully compensate you for your losses. In such cases, UIM coverage becomes invaluable. UIM coverage will bridge the gap between the at-fault driver’s insurance coverage and the actual cost of the damages, up to the limits of your policy.

For example, let’s say you are involved in an accident with a driver who has the minimum required liability coverage, which is often inadequate to cover the expenses associated with a serious accident. If your medical bills and vehicle repairs exceed the at-fault driver’s coverage limits, your UIM coverage will kick in and cover the remaining costs, ensuring that you are not left with a hefty bill.

3. Peace of Mind

Accidents can be stressful and overwhelming, both emotionally and financially. Having UM/UIM coverage provides you with peace of mind, knowing that you are protected in the event of an accident with an uninsured or underinsured driver. It allows you to focus on your recovery and getting your life back on track, rather than worrying about the financial implications of the accident.

How UM/UIM Coverage Helps in an Accident

Now that we have established the importance of UM/UIM coverage, let’s explore how this coverage can help you in the unfortunate event of an accident.

1. Medical Expenses

Medical expenses can quickly add up after an accident, especially if you require hospitalization, surgeries, or ongoing treatment. UM/UIM coverage can help cover these expenses, ensuring that you receive the necessary medical care without incurring significant out-of-pocket costs.

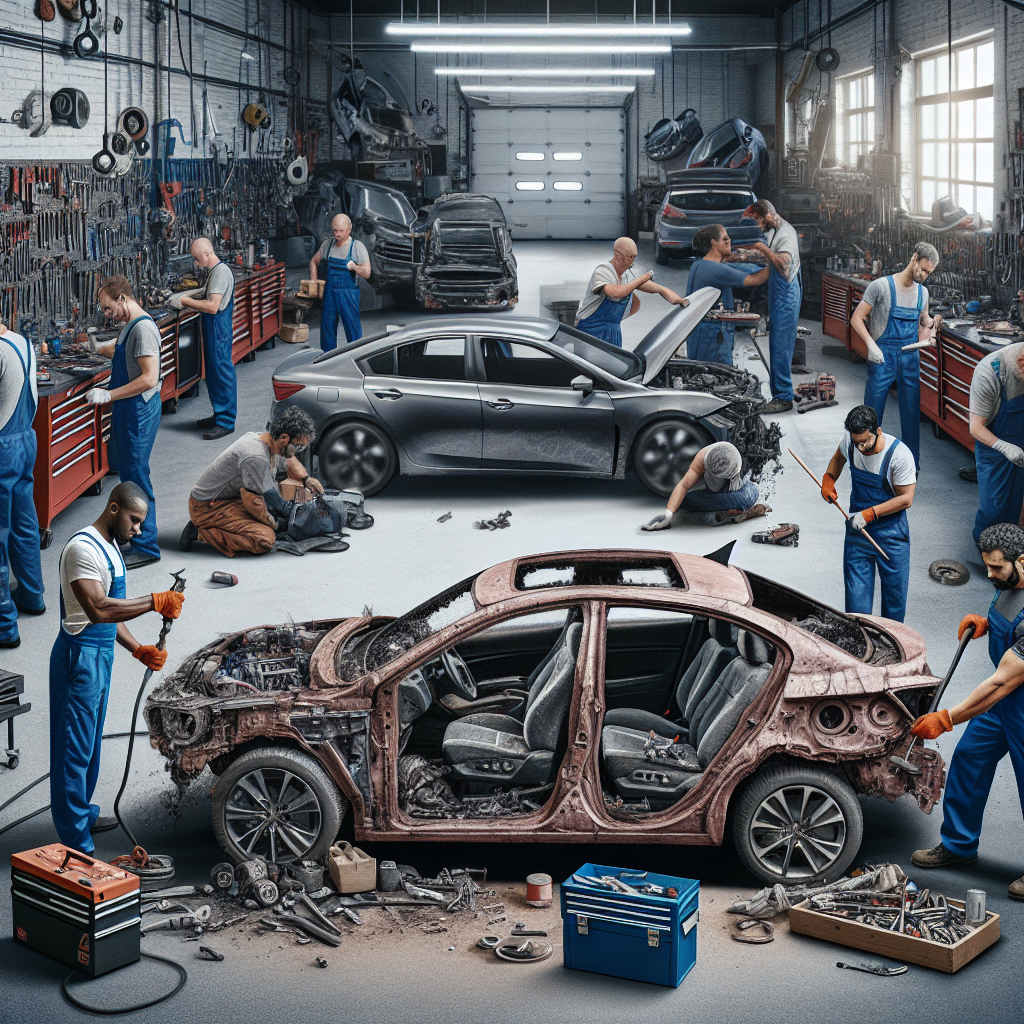

2. Vehicle Repairs

If your vehicle is damaged in an accident, the cost of repairs can be substantial. UM/UIM coverage can help cover the expenses associated with repairing or replacing your vehicle, allowing you to get back on the road as quickly as possible.

3. Lost Wages

If you are unable to work due to injuries sustained in an accident, you may experience a loss of income. UM/UIM coverage can provide compensation for lost wages, helping you maintain financial stability while you recover.

4. Pain and Suffering

In addition to the tangible costs of an accident, such as medical expenses and vehicle repairs, there are also intangible costs to consider. UM/UIM coverage can provide compensation for pain and suffering, which includes physical pain, emotional distress, and the impact the accident has on your overall quality of life.

Case Studies and Statistics

Let’s take a look at some real-life examples and statistics that highlight the importance of UM/UIM coverage:

Case Study 1:

John was driving home from work when he was rear-ended by a driver who did not have insurance. John suffered severe injuries and required extensive medical treatment. Fortunately, John had UM coverage, which covered his medical expenses and provided compensation for his pain and suffering.

Case Study 2:

Sarah was involved in an accident with a driver who had the minimum liability coverage. However, the cost of repairing Sarah’s vehicle and her medical expenses exceeded the at-fault driver’s coverage limits. Sarah’s UIM coverage kicked in and covered the remaining costs, ensuring that she did not have to pay out of pocket.

Statistics:

- According to the Insurance Information Institute, in 2019, the uninsured motorist rate in the United States was 12.6%.

- A study conducted by the Insurance Research Council found that the average claim payment for bodily injury under UM coverage was $17,024 in 2017.

- The same study found that the average claim payment for property damage under UM coverage was $3,574 in 2017.

Conclusion

UM/UIM coverage is a vital component of your auto insurance policy. It provides protection against uninsured and underinsured drivers, ensuring that you are not left with the financial burden of an accident. This coverage can help cover medical expenses, vehicle repairs, lost wages, and provide compensation for pain and suffering. By including UM/UIM coverage in your policy, you can have peace of mind knowing that you are adequately protected in the event of an accident. Don’t overlook this important coverage option when selecting your auto insurance policy. If you ever get into an accident and need legal representation, feel free to give us a call at 702-999-8888.